Cet article nous propose une étude étayée et documentée sur un des leviers majeur de puissance de la Russie. L’auteur nous décrit ainsi successivement l’évolution de la production de gaz russe et la stratégie déployée par l’entreprise emblématique qui structure ce secteur : Gazprom. Ces descriptions permettent de mieux saisir les enjeux et défis auxquels ce secteur essentiel pour l’économie russe est confronté.

Les opinions exprimées dans cet article n’engagent pas le CSFRS.

Les références originales de ce texte sont : Catherine Locatelli, « The natural gas industry in Russia: reforms under debate », Encyclopédie de l’énergie.

Ce texte, ainsi que d’autres publications peuvent être visionnés sur le site de l’Encyclopédie de l’énergie :

The natural gas industry in Russia: reforms under debate

(Les tableaux et images présents dans l’article peuvent être agrandis en cliquant dessus)

Once the world’s largest producer of natural gas, Russia passed to second behind the United States following the rise of American shale gas in 2013. The gas industry remains nonetheless one of the most important sectors of the Russian economy. Natural gas exports are a key variable in the country’s economic policy, particularly as regards the stability of the state budget. While the sheer size of its reserves shelters Russia from the possibility of negative surprises, in 2014 the gas industry finds itself confronted by a number of constraints and uncertainties both internally and in foreign markets. Regulatory, economic, and institutional factors will all have an impact on pending choices and thus the long-term future of this industry.

1. Russian natural gas production

The extensive nature of its gas reserves, estimated by British Petroleum (BP) at 32.9 trillion cubic meters, or 17.6% of the world total, gives Russia reason to anticipate high levels of production and exportation over the long term. There are however a number of factors that could inhibit such development.

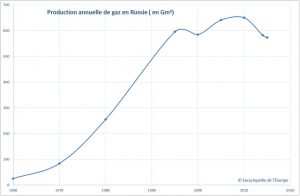

Following a strong start with annual growth rates above 10% between 1960 and 1980, gas production levels began to even out in the mid 1990s and then decline as of 2010 (Table 1 and Image 1). This downward trend resulted from decreasing production at the three super-giant gas fields of Urgenoy, Yamburg, and Medveze. Originally developed by Gazprom, these fields had since reached maturity.

Image 1 : Russian gas production 1960-2016 – BP statistical energy review

New zones for possible development include gas fields in the Yamal peninsula (Bovanenkovo) (Image 2), satellites of the Nadym-Pur-Taz region, Eastern Siberia (Chayandinskoye and Kovyktinskoye), and certain border-areas (the Shtokman and Sakhalin offshore fields). Later projects are also envisaged for the development of fields in the Kara Sea (Leningradskoye and Rusanovskoye).

Image 2 : Yamal Peninsula – Source : Siberiantimes.com

As all of these zones cannot be developed simultaneously, the Russian gas industry must select which zones to give priority.

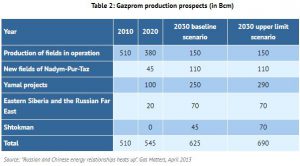

According to Gazprom, production in the Yamal peninsula and Eastern Siberia could represent more than 20% of the company’s total production by 2020, and more than 50% by 2030 (Table 2).

Development of new production zones implies the complementary construction of an extensive system of pipelines (Image 3), and therefore considerable financial investment. The growth in production in the Yamal peninsula, given the predicted levels, will require the construction of a pipeline system comprised of six sections stretching across the Bovanenkovo-Ukhta corridor. However, the weak demand for natural gas in both internal and export markets (namely the European Union), casts doubt on the need to start production in these zones in the short term. Changes in demand therefore compel Gazprom to periodically lower its production targets and delay further investment in the extension of its production capacity.

Image 3 : Natural gas pipeline – Source : David Mark, Pixabay

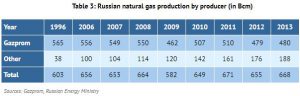

Alternatives to the costly development of these new production zones do exist. Independent Russian gas companies such as Novatek, as well as major Russian oil companies like Rosneft and Lukoil, are becoming significant gas producers. Furthermore, these companies are able to operate at lower production costs than Gazprom.

Image 4 : Bovanenko in the spring, Yamal peninsula – Source : Gazprom

Although available estimates quote differing levels of production (Table 3), in 2013 J. Henderson estimated that independent producers and oil companies had sufficient reserves to produce 350 Bcm by 2020. What is more, the locations of these reserves suggest that the cost of their development would be less than that of the new production zones envisioned by Gazprom. The situation is better still for the oil companies: as the profitability of their fields depends primarily on the petroleum extracted, they are able to incur a lower valuation of their associated gas in competing with Gazprom.

A strategic question thus arises. Should Russia continue to base its gas development solely on the construction of mega-projects carried out by Gazprom, or should it diversify its supply by drawing on production from numerous smaller gas fields operated by independent gas companies? The costs of Russian supply, and thereby its export competitiveness, could be significantly affected. The answer to this question depends on many variables: access to the Gazprom transport system, changes in internal gas prices, and above all, the export strategy.

2. Gazprom’s export strategy

As the recipient of 178.3 Bcm of gas in 2016, Europe (excluding the Baltic States) remains Gazprom’s and Russia’s preferred export market (Table 4). This has long been the case, as it is the most profitable. The collapse of the Soviet Union in 1991 caused some disturbance to this trade scenario due to the appearance of new transit countries, such as Ukraine and Belarus, which were previously members of the USSR. Even so, the strategy of maximizing Gazprom exports to Europe was not called into question.

The gas trade between Russia and Western Europe (Image 5) dates to the end of the 1960s, the first contracts with the Soviet Union having been signed by Austria in 1968, the Federal Republic of Germany in 1973, and then Italy and Finland in 1974. But it would not be until the 1980s and the conclusion of the first major trade agreements with countries of the European Union (EU) that these trade relations would become significant. They comprised bilateral agreements consisting of long-term, Take or Pay (TOP) contracts signed with Germany, France, and Italy.

Image 5: Existing and and proposed gas pipelines between Russia and Europe – Source : Gazprom

This period was characterized by the stability of the gas trade between the two zones, at least in economic terms. The TOP contracts allow for a sharing of price risk and volume risk between the producer and the consumer all along the gas chain, and in this way they foster security. Such contracts ensure the development of stable and mature gas supply systems (Boussena S., 1999). They assure that substantial investments are made in production and transport. In particular, long-term contracts enable producers to develop their gas fields and the infrastructure necessary for exportation.

Within this context, the question of EU gas security arose first and foremost as a political matter, particularly with regard to American concern over excessive European dependence on the Soviet Union. It was from this perspective that in 1981-82, the Reagan administration imposed a trade embargo on exports to the Soviet Union concerning materials for the construction of pipelines towards Europe (Stern J., 1987). Under the aegis of the International Energy Agency (IEA), though informally, European countries committed themselves to restricting their importation of gas coming from the USSR. Although no numbers were published, it appears that Germany, France, and Italy limited themselves to fulfilling no more than 30-35% of their gas needs with Soviet supply.

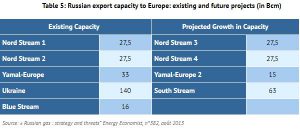

In 2013, Russia’s export capacity was 244 Bcm. Given the development projects already underway, this capacity could eventually reach 377 Bcm. As it stands, there are three major export channels toward Europe: one through the Ukraine (the original route), one through Belarus (Yamal I pipeline), and Nord Stream, the first Russian pipeline not to cross any transit countries, arriving in Germany via the Baltic Sea. In addition, the Blue Stream pipeline connecting Russia to Turkey under the Black Sea, has a capacity of 16 Bcm. Future growth in Russian export capacity is expected to transpire mainly through the augmentation of the Nord Stream pipeline capacity, and the possible creation of a controversial new corridor: the South Stream (Table 5).

While the EU remains Gazprom’s priority export region, the liberalisation of the European gas market, its weak growth in demand for gas, and the rise of shale gas, all have profound implications for the trade contracts between the gas company and EU countries. These changing circumstances obligate Gazprom to define strategies for adaptation.

2.1. Possible modification of Gazprom’s price-quantity trade-off strategy

Increasing the flexibility of long-term contracts is a pivotal issue for trade relations between the EU and Russia. Revising the price indexation formula to include spot prices for gas is at the heart of the debate, and is the object of negotiations between Gazprom and European companies. Gazprom continues to firmly oppose changes to the formula itself and to defend gas prices indexed on those of petroleum and petroleum products. In so doing, the gas company seemed for a time to be favouring a strategy of maintaining price levels at the expense of losses in volume. As of 2014, Gazprom has begun to renegotiate contracts with its principal clients on the basis of lowering its prices while nonetheless keeping its price indexation formula unchanged.

2.2. Gazprom’s downstream integration strategy

Another means of adaptation was for Gazprom to attempt to develop a downstream integration strategy in European gas markets. For a supplier, market share or outlets in a liberalized market are usually secured by investing in downstream operations closer to consumer markets. This guarantees, by way of asset acquisition in transport and distribution companies, or companies that use gas (like electricity producers), an outlet for its resource without having to compete with other producers in a wholesale market. In regard to price, in a seller’s market, downstream integration allows for the recuperation of the margin that retailers derive at the point of final sale.The asset acquisition policy that Gazprom has pursued in France since the late 1980s subscribes to this logic, as it is clear that access to final consumers is its main objective. Gazprom has also established similar objectives for Italy or the Czech Republic.

Gazprom’s utilization of this strategy has demonstrated some characteristics worth noting. Up until the early 2000s, it was employed in a predominantly cooperative fashion in conjunction with Gazprom’s traditional European clients. Effectively, It consisted of the creation of joint ventures in the transport and trading sectors, mostly with traditional operators; the signatories of long-term contracts like Österreichische Mineralölverwaltung (OMV), Gaz de France (GDF) la Società Nazionale Metanodotti (SNAM), and l’Ente Nazionale Idrocarburi (ENI). Since then, Gazprom’s downstream integration strategy has become more competitive, as the company has taken to selling gas directly on these countries’ markets.

This strategy is all the more important for Gazprom given that it contributes to one of the primary goals of Russian energy policy: endowing the country with major internationalized hydrocarbon companies capable of rivalling the industry’s major multinationals. The greatest obstacle to the realisation of this strategy lies in legislation enacted by the EU. In fact, certain aspects of the Third Energy Package pointedly discourage it. The third country clause (sometimes referred to as the anti-Gazprom clause), and the ownership unbundling policy indeed condemn Gazprom’s downstream integration strategy and pave the way for discriminatory treatment of foreign investment. These regulations exclude a foreign producer and supplier like Russia from being able to hold a majority share in EU transport systems, or from being a transmission system operator (TSO) in a member state (Willems et al., 2010).

2.3. The diversification of export markets: the Liquid Natural Gas (LNG) option

The obvious strategic response to the constraints of the European market lies in market diversification, a policy that Gazprom intends to pursue with the support of the Russian state. In this way, Russia could relieve its overdependence on the European market. This policy was particularly encouraged in the early 2000s within a context made up of: the reassertion of control over the sector by the Russian government, perceptions of resource scarcity in the long term, and competition amongst major importing nations for access to hydrocarbon resources. The primary focus of this strategy is the development of Asian markets, particularly those in Japan, China, and South Korea.

This strategy relies on the exportation of liquid natural gas (LNG) (Image 6). LNG is the only resource for which market conditions allow for true diversification, as gas producers are able to engage in price arbitrage.

Image 6 : A Russian LNG tanker – Source : https://fr.sputniknews.com

Advertising this strategy allows Russia to suggest the existence of competition between European and Asian markets, when in reality there is none. In the absence of a truly global market for natural gas, on account of transport costs and current pricing, Russia’s gas fields are relatively captive and are only profitable in connection with one destination or the other. However, if Russia manages to develop its Asian markets, it would be in a better position to influence natural gas prices on an international scale (Boussena S., Locatelli C., 2005).

Pipeline projects toward China involve gas fields located in Eastern Siberia, far from the European market (Image 7). The main gas fields concerned are those of Kovyktinskoye (in the Irkutsk region), Chayandinskoye, and Talakan (in the Sakha Republic). There is only one project, the proposed Altai pipeline, that would involve gas fields in Western Siberia. At this time, it appears that Gazprom is focusing on the development of the Chayandinskoye field for 2016, the gas from which could potentially be transported in a Chayandinskoye-Khabarovsk-Vladivostok pipeline. The project’s primary purpose is to supply Russia’s Far East with gas, but its profitability will depend in large part on exports, particularly to China.

Image 7 : Existing and proposed natural gas pipelines between Russia and China – Source : Gazprom

Russia has plans for many LNG projects, and not all of them involve Gazprom (Table 6).

Of the six principal LNG export projects with target markets in Asia, three do not involve the participation of Gazprom (Image 8). These projects include Sakhalin I (Rosneft-ExxonMobil), Yamal LNG (Novatek-Total), and Pechora LNG (TNK-BP, acquired by Rosneft in 2013).

Image 8 : Terminal Novatek de GNL au Yamal – Source : leblogfinance.com

3. The “Gazprom model”

The Russian gas sector is built around the gas company Gazprom (Image 9). Vertically integrated from production to distribution, Gazprom has a quasi-monopoly in Russian gas production. The Russian government owned a controlling 38% share in Gazprom up until the early 2000s, at which point it became the majority shareholder with 51%. At the same time, independent Russian oil and gas companies grew in importance, producing 28% of Russian gas produced in 2013, as previously shown in Table 3. Gazprom maintains nonetheless its monopoly on transport (pipelines), while over the course of the 2000s, its monopoly on gas exports to Europe expanded to include all gas exports and thus the potential Asian markets. However, as of 2014, Gazprom no longer has a monopoly on the exportation of LNG.

Image 9 : Gazprom logo – Source : Wikimedia Commons

3.1. The recurring debate over reform of the Gazprom holding company

In order to understand the debate over the reorganization of the gas industry that has been ongoing in Russia since the early 2000s, it must be examined within a historical context. The financial holding company Gazprom is a direct descendent of the Soviet Ministry of Gas Industry. It was born from the reform of the Russian gas industry begun by Mikhail Gorbachev and continued through 1991 and 1992 following the collapse of the Soviet Union and its centrally planned economy. Built on the foundations of the Soviet gas ministry, the holding company retained 100% of the shares of nine ministry production associations thereafter transformed into production companies. It also retained 100% of the shares of the transport company Transgaz, and the export company GazExport. Thus, Gazprom became a vertically integrated company with control over all operations from production to distribution, including transport and exportation (Locatelli C., 2003). In 1993, it was responsible for 93% of Russian gas production and held a monopoly on pipeline transport and exports.

Ever since, reform of the Russian gas industry has been mired in conflict between the proponents of centralisation and those of liberalisation. Since 1993, a de-integrated, competitive model based on the gas industries of the EU was explicitly envisaged by a number of reformers, including Herman Gref, the eventual Minister of Economic Development and Trade in 2000.

Proposed reform became centred on the reversal of Gazprom’s vertical integration. Under such reform, ownership was to be unbundled by separating the company’s production and transport functions, in an attempt to isolate the competitive segments from those with a natural monopoly. Six independent producers were to be built out of the production companies solely owned by Gazprom. Once reduced to the unique role of transporter, the company would operate as a regulated natural monopoly while allowing third-party access to the transport system. In the only divergence from the European model, Gazprom would have kept its monopoly over the export of Russian gas. In a final step (envisioned for 2007-2013), Gazprom’s activities were to be confined exclusively to exportation. Indeed, the reformer position is a lot more relaxed on the subject of gas export liberalisation, particularly regarding exports to Europe, as it is not a priority issue for them (Locatelli C., 2003).

The feasibility and credibility of reforms for increased competition in the gas industry are rather dubitable given the economic and institutional environment in Russia. Two institutions in particular pose a problem: property rights, and above all, the coordination mechanism for monetary relations and prices.

The “Gazprom model” endures as it responds to the economic uncertainties created by this environment. It is the organisational and institutional model that best facilitates the management of the non-monetary transactions that developed on a big scale during the 1990s, accounting for as much as 97% of domestic gas sales in 1996-97. Even if these non-monetary relations were to disappear over the course of the 2000s, the maintenance of low energy prices inhibits competition for two reasons. Firstly, the price structure involves significant cross-subsidization between the industrial and residential sectors, the latter sector being subsidized by the former. Secondly, it can be assumed that these prices, at least up until the early 2000s, were on average inferior to Gazprom’s marginal cost of production, which limited profitability for the other players in the gas industry. In 2001, prices ranged from 10$/1000 for households to 15 – 16$/1000 for industry, compared to 120$/1000 for exports to Western Europe.

The “Gazprom model” also responds to the uncertainty that surrounds property rights. A priori, Gazprom’s governance and capital structure suggest that problems typically associated with corporate governance, like a fragmented shareholder base dominated by “insiders”, are less prevalent at Gazprom than in the privatized schemas of the Russian oil sector.

Furthermore, transactions between the Gazprom financial holding company and its subsidiaries are conducted using transfer prices. These are the prices at which the holding company, by way of Transgaz, buys gas from its production subsidiaries. As they are generally set below the cost of production, the use of transfer prices allows Gazprom to keep its production subsidiaries in debt, and thereby considerably limit their autonomy (Kryukov V. and Moe A., 1996). In this way, Gazprom’s organisational structure preserves the centralisation of investment financing and enables the holding company to define the investment strategies of its production subsidiaries (Locatelli C., 2003).

3.2. Management of the Russian gas market by quantity

The Russian gas sector is managed according to quantities, by way of consumption quotas. Gazprom negotiates the supply of gas with the major consumer categories at prices administered and regulated by the Russian state (Ahrend R. and Thompson W., 2004). By regulating the market in terms of quantity, regardless of profitability, cost, or price, the Russian economy benefits from a stable and inexpensive supply of gas, even despite the insolvency of many distributors and industrial and household consumers.

This supply helps ensure the continuity of industrial activity, gas being one of the principal fuels for the production of electricity. Numerous authors have emphasised the special role played by Gazprom within the Russian economy, as the gas sector helps to subsidize the rest of the economy (Gaddy C. and Ickes B., 1999; Woodruff D., 1999).

Gazprom’s privileged access to revenue from the European export market enables it to finance its investments. In return for this access to revenue in foreign currency, Gazprom must guarantee the long-term contractual engagements (TOP contracts) with European countries. It is without a doubt Gazprom’s hierarchical governance structure that allows it to assure both contract continuity with its European clients and the reliability of the Russian gas supply.

3.3. Gazprom’s efficiency under question

Nonetheless, Gazprom’s efficiency remains at the heart of the debate surrounding the organisation of the gas sector. Studies of Gazprom, though sparse, reveal characteristics that provide a basis for criticism of the company’s inefficiency.

Of note are the agency problems. Often referred to as a state within a state, there have been issues with Gazprom turning its back on the best interests of its principal stockholder, the Russian government (Nemstov B. and Milov V., 2008). Meanwhile, the company’s mediocre economic performance is underlined by a lower return on assets than experienced by the privatized Russian oil companies, a problem of overemployment, high production costs, and a deterioration in the financial situation of the company in the 2000s, accompanied by a 60% growth in its debt between 2005 and 2010 (Victor N., 2008; Victor N. and Sayfer I., 2011).

It should be acknowledged however that it is difficult to determine what portion of these deficiencies is attributable to the low price of gas and what is due to poor management. Between 2008 and 2012, in spite of a decrease in the volume of sales on the internal market, the revenue generated therein increased considerably.

4. Moving towards reform of the Russian natural gas industry?

Since 2014, the “Gazprom model” is undergoing changes that suggest the possibility of major reform in the Russian natural gas industry.

4.1. The emergence of competition in the Russian gas sector

The economic and institutional environment in Russia remains prohibitive to the implementation of a model that would involve a total unbundling of Gazprom. However, changes in the international arena, such as the development of shale gas and the increasing competitiveness of markets, are forcing Russia and Gazprom to adopt more flexible strategies, especially concerning contracts.

There is also a trend towards mounting competition in Russian internal markets, exemplified by the rising power of independent gas companies and Russian oil companies seeking to monetise their gas reserves (Image 10).

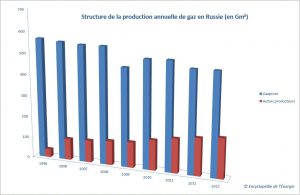

Image 10 : The emergence of gas producers other than Gazprom in the Russian gas sector – Own Source, data obtained from Gazprom and Russian Energy Ministry

Competition thus emerges as an essential institution for the reform of the gas sector. It serves a dual objective. The first and relatively traditional purpose from an efficiency standpoint would be to discipline Gazprom’s conduct. The second would be to allow the Russian state to reduce information asymmetries in its dealings with Gazprom, often referred to as a state within a state (Nemstov B. and Milov V., 2008). This would require that the state gain access to certain fundamental information, particularly the cost of production, and the levels of pricing and taxation that would render Gazprom companies profitable.

4.2. Russia’s dual gas market

The hierarchical nature of Gazprom’s governance structure is congruent with the emergence of a competitive fringe in certain segments of the Russian gas market. The holding company never had a monopoly on exploration and production activities, as evidenced by the gradual arrival of new players in the gas sector such as the independent gas and oil companies. The arrival of these players gave rise to the creation of a dual market; one segment operating on state-regulated prices, and the other on free-market prices (Ahrend R. and Tompson W., 2004).

Residential gas supply is assured by the state-regulated market at prices fixed by the Federal Tariff Service (FTS). The FTS sets wholesale prices for various price zones that account for differences in geographic location and consumer category. Gazprom is the sole supplier to this market.

The state-regulated market also supplies the industrial sector (particularly the electricity sector), but by way of quotas negotiated with Gazprom. Beyond the negotiated quantities, consumers can procure gas on the unregulated market. This market is mainly supplied by independent gas and Russian oil companies, and to a small extent by Gazprom’s ‘new gas’. ‘New gas’ refers to gas coming from Gazprom’s newly developed fields, where the cost of production is higher than that at fields in operation since the 1970s, such as Urengoy or Yamburg.

Consequently, there is a partial movement toward gas price liberalisation via the growth in volumes being traded on the unregulated market. This is accompanied by substantial rises in the state-regulated prices. Between 2006 and 2010, these prices grew by 124% for the industrial sector and 121% for the residential sector (Table 7). Such increases seem sufficient to assure both Gazprom’s profitability, and an alignment of the administered prices with those of the unregulated market (Henderson J., 2013). The nature of the double market and the progressive growth of administered gas prices allow independent gas and Russian oil companies to gradually compete with Gazprom in significant segments of its market, namely in the industrial and electricity sectors. Competition between Gazprom and the other gas players is also made possible by stricter enforcement of access to Gazprom’s transport system.

It is important to recognize that Gazprom may have had a vested interest in the development of gas production by independent gas and Russian oil companies as far as such production has been, and will likely continue to be, an important factor for balance and stability in the Russian gas market.

It is certain that Gazprom uses the double market as an adjustment variable in its production and exportation strategy. In accordance with market needs, Gazprom’s monopoly over the gas transport system allows it to refuse or accept to deliver gas produced by independent companies, and can thusly regulate market supply. At the very least, this mechanism has enabled Gazprom to fulfil its contractual obligations to European countries in periods when it was experiencing great strain on its production.

Bibliography

- Ahrend R., Tompson W. (2004). Russia’s Gas Sector: The Endless Wait for Reform ?. Paris : OECD. Economics Department Working Paper n° 402

- Boussena S. (1999). New European gas market: gas strategies of other present and potential suppliers. Communication à: 1999 International Conference: The role of Russian and CIS Countries in Deregulated Energy Markets. Paris: Centre de Géopolitique des Matières Premières-Université Paris Dauphine. Paris, 6-7 December

- Boussena S., Locatelli C. (2017). Gazprom et l’incertitude du marché gazier européen : vers une stratégie de défense de sa part de marché? Revue d’Economie Industrielle, n° 157

- Gaddy C. & Ickes B. (1999). An Accounting Model of the Virtual Economy in Russia. Post-Soviet Geography and Economics, vol. 40, n° 2

- Henderson J. (2013). Evolution in the Russian gas market: Competition for Consumers. Oxford Institute for Energy Studies (Working paper NG73)

- Henderson J. (2010). Non Gazprom Gas Producers in Russia. Oxford Institute for Energy Studies, 255p

- Kryukov V., Moe A. (1996). The new russian corporatism? A case study of Gazprom. Post-Soviet Business Forum. Londres: The Royal Institute of International Affairs, 40p

- Locatelli C. (2008). Gazprom’s export strategies under the institutional constraint of the Russian gas market. Opec Energy Review, vol 32, n°3, pp. 246-64

- Locatelli C. (2003). The viability of deregulation in the Russian gas industry. Journal of Energy and Development, vol. 28, n° 2, pp. 221-238

- Nemtsov B., Milov V. (2008). Putin and Gazprom : An independant expert report. Moscow.

- Mitrova, T. (2014). The geopolitics of Russian Natural Gas. Rice University: James A. Baker III Institute for Public Policy

- Stern J. (2011). Future gas production in Russia: Is the concern about lack of investment justified?Oxford Institute for Energy Studies

- Stern J. (2005). The Future of Russian Gas and Gazprom. Oxford Institute for Energy Studies, 270p

- Stern J (1995). The Russian natural Gas Bubble : Consequences for European Gas Makets. London: Royal Institute of International Affairs

- Victor N. (2008). Gazprom: Gas Giant under Strain. Stanford University (PESD Working Paper), n° 71.

- Victor N., Sayfer I. (2011). Gazprom : The struggle for power, in Victor D., Hults D., Thurber M. (2011) Oil and governance: State-Owned Enterprises and the World Energy. Business & Economics

- Williamson O. (2000). The New Institutionnal Economics: Taking Stock, Looking Ahead. Journal of Economic Literature, Vol 38 (September), pp. 595-613

- Wood Mackenzie (2004). Time to Step on the Gas. Will Russia Realise its Potential?Multi-Client Study

- Woodruff D. (1999). It’s value that’s virtual : Bartles, Rubles, and the place of Gazprom in the Russian economy. Post-Soviet Affairs vol. 15, n°2, pp. 130-148

Par : Catherine LOCATELLI

Source : Encyclopédie de l’énergie

Mots-clefs : Energie, Europe, Gaz naturel, Gazprom, Marchés, Politique, Russie, Union soviétique