Les exportations d’armements vers l’Asie orientale constituent-t-elles une illustration de l’absence d’une véritable réflexion stratégique au sein de l’UE? C’est la thèse que développe cet article. Il analyse les tendances à l’œuvre et évalue l’impact, paradoxal et sous-estimé, tant des ventes de matériels militaires que des transferts de technologies duales, sur l’équilibre régional entre la Chine et ses voisins. Au-delà d’un simple état des lieux, les auteurs proposent l’adoption par l’UE d’une approche cohérente et globale, en l’illustrant de diverses recommandations.

——————————————————————————————————————————————-

Les opinions exprimées dans cet article n’engagent pas le CSFRS.

Les références originales de ce texte sont: Mathieu Duchâtel et Mark Bromley, « Influence by default: Europe’s impact on military security in east asia », Policy Brief, ECFR, 16 mai 2017.

Ce texte, ainsi que d’autres publications, peuvent être visionnés sur le site de l’ECFR.

——————————————————————————————————————————————

Influence by default: Europe’s impact on military security in east asia

The influence that the European Union and its member states exert on the military balance in Asia has, for many years, received only passing attention. In Europe, the discussion of Asian security has long been stuck on the allegedly limited influence the EU exerts through diplomatic statements which tend to focus on: the value of international law; regional economic and political integration; and confidence-building on the Korean peninsula and in the East China Sea and South China Sea. As a result, commentators lament that the EU has only had a negligible impact on the behaviour of Asian states, leading many in Europe to conclude that involvement in Asian security is hopeless. Some also argue that greater involvement could be costly for Europe. They fear that standing up for maritime law risks a negative impact on Europe-China relations, and believe that Europe’s resources should not be diverted away from the national security priorities of handling renewed Russian assertiveness and the risk of new terror attacks.

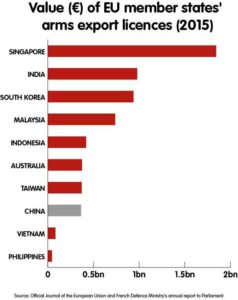

However, this discussion misses a key element of Europe’s influence on security in the Asia-Pacific: the supply of military-relevant technology – both intentional and unintentional – and controls on transfers of arms and dual-use goods. EU member states sell complete weapons systems, their parts, and components, to many recipient states in Asia. According to the Official Journal of the European Union, in 2015 EU member states issued licences for the export of military equipment to Asia and Oceania worth €44.1 billion, compared with €30.2 billion in 2014[1].

In addition, although new data from SIPRI shows that between 2007-11 and 2012-16 the volume of EU member states’ arms exports to Asia and Oceania fell by 27 percent, transfers to Oceania rose by 71 percent. EU member states have also recently signed a number of big-ticket contracts which may see their share of supplies to the region rebound in the years ahead. EU-based companies are still among the world’s leading suppliers of submarines, other naval-based systems, and anti-access/area denial systems (A2/AD) that states in the region, particularly in south- east Asia, are keen to acquire[2].

Declining defence budgets within Europe, and rising budgets – and tensions – in parts of Asia, mean there is a new imperative for EU member states and EU-based companies to target the region for sales. Indeed, EU-based suppliers have also shown a growing willingness to offer generous technology transfer agreements in order to conclude deals. Equally, EU member states actively impact on the military balance in Asia via transfers of technical know-how – so called intangible technology transfers (ITT) – which are not accurately captured in arms trade statistics. These can occur via sales in the defence and civil sectors, inward and outward investment deals, mergers and acquisitions, and academic cooperation.

This policy brief seeks to give an account of these trends to better understand the impact of EU member states on the Asian military balance. It focuses on 11 key leading Asian spenders selected on the basis of their involvement in security hotspots in East Asia: the East China Sea, the South China Sea, the Taiwan Strait, and the Korean peninsula. These countries are: Australia, China, India, Indonesia, Japan, Malaysia, the Philippines, Singapore, South Korea, Taiwan, and Vietnam[3]. While nine spenders are directly involved in the four hotspots, Australia and India have been included as Asia-Pacific powers which have a declared stake in East Asian security and an ambition to influence the balance of military power in that region.

The paper provides an account of trends in military spending and armaments in these 11 leading spenders. It then examines the role that transfers of military equipment from EU member states are playing in these developments. Two key points emerge. First, it is commonly argued that East Asia is experiencing an ‘arms race’ in which countries try to match each other directly in terms of military capability. However, Europeans can grasp their true impact on the region if they understand that, rather than an arms race, the dynamic is better characterised as one in which states are engaging in acquiring asymmetric capabilities in order to make the cost of conflict too high and thereby prevent any excessive unbalance with China. On that basis, the need for a coordinated approach with regard to arms exports to the region is essential, if EU member states are to avoid transfers that might contribute to greater tensions in the region.

Second, with direct regard to Europe’s relationship with China, the issue of the arms embargo – once the principal matter of concern – is now no longer on the agenda. China has ceased to demand it be lifted. Of far greater concern is the potential for transfers of dual-use technology playing a role in boosting China’s defence industry, again highlighting the need for coherence and coordination at the EU level. Europeans urgently need to understand that they are contributing to China’s rise as an arms exporter – and therefore as a competitor to themselves and others.

Taken together, in this way Europe is clearly exerting an influence on the military balance Asia. But this is an outcome driven by a mix of commercial interests and political constraints. It is not guided by any clearly defined strategy at EU level, despite the EU’s role in controlling arms exports and technology transfers. Member states’ own strategic preferences also fail to amount to any coherent approach. The EU can seize on a number of tools at its disposal to develop a more harmonised, transparent, and effective set of policies when it comes to controlling the trade in military- relevant technologies that impact the East Asian security architecture. The paper calls for the EU to formulate a more strategised approach that reflects European interests and responds to the current fragilities in East Asian security.

Armament trends in Asia: The big picture

In early March 2017, the Trump administration announced it would seek an increase in military spending of $54 billion in 2018, roughly the size of the defence budget of the United Kingdom, the fifth largest in the world. This allowed China’s Xinhua agency to present the subsequent announcement by China of an increase of seven percent of its defence budget for 2017 as being “eclipsed” by the United States[4]. While China’s increase in spending is the slowest since 2010, it is also roughly the same size as Singapore’s defence expenditure ($10 billion), the sixth largest in Asia. China consistently portrays its military spending as modest in comparison with the that of the US, both in real terms ($144.2 billion against $577 billion in 2015 according to official figures) and in terms of military burden (1.3 percent of GDP against 3.3 percent for the US according to official figures)[5].

These successive announcements point to the structure of the East Asian security order. In Washington the Trump administration has hinted at a robust naval build-up and deployment in the Asia-Pacific to balance the rise of Chinese military power[6]. In Beijing, military modernisation aims primarily at deterring a US intervention involving Taiwan. As such, the US and China are locked in a ‘security dilemma’, a situation in which states engage in costly military build-ups largely due to uncertainty about each other’s true intentions, even if their primary concern is defensive[7].

The rivalry between the US and China determines the strategic space and the range of national security policy options open to all states in the region. Nonetheless, the East Asian military balance is not purely a US-China game. Several states are involved in their own independent territorial disputes with China. They have responded to the modernisation of the Chinese military by, in turn, increasing their own military spending or by acquiring asymmetric capacities to prevent China from gaining an overwhelming military advantage. Given that no state in the region can match the level of expenditure of the Chinese military and that the spending gap will only grow further, they develop asymmetric capacities to deny China air superiority and maritime supremacy. Indeed, there is a ‘double asymmetry’ game in Asia. China has been pursuing asymmetric capacities to raise the costs of a US military intervention since the 1995-96 Taiwan Strait crisis.

Current military expenditure patterns andarms procurement dynamics in Asia have led to the emergence of an ‘Asian arms race’ narrative, both in mainstream media and academic publications[8]. Thisnarrative had already emerged in the early 1990s but it became mainstream after the 2009 financial crisis[9]. In early 2017 a new wave of warnings emerged about a new ‘arms race’. Some Western analysts have argued that a possible decrease in US commitment to Asian security under the unpredictable Trump administration would lead to such a new arms race between Asian states. Conversely, Chinese analysts are arguing that the recent deployment of the US- built Terminal High Altitude Area Defence (THAAD) anti- missile defence system in South Korea will be the cause[10]. The term ‘arms race’ suggests that states in East Asia are engaged an ongoing process of competitive behaviour in which the primary goal of their arms acquisitions is to keep pace with rival states[11]. This could increase the chance of armed conflict in the region. However, a closer analysis of armament trends in East Asia shows that the region is not yet engaged in a destabilising arms race.

Overall, states from Asia and Oceania are involved in a series of increases in their military expenditure and are pursuing ambitious and expansive military equipment acquisition programmes[12]. SIPRI data indicates that military expenditure in Asia and Oceania rose from $274 billion in 2006 to $450 billion in 2015 (in constant $2015), an increase of 64 per cent. Military expenditure has grown by 75 per cent in East Asia, 44 per cent in central and south Asia, and 57 per cent in south-east Asia between 2006 and 2015 – while it decreased by 8.5 percent in western and central Europe[13]. Today, five of the top 15 military spenders are located in Asia (China, India, Japan, South Korea, and Australia). In addition, SIPRI data indicates that arms imports by states in Asia and Oceania increased by 4 percent between 2007- 11 and 2012-16 and accounted for 41 percent of global arms transfers. India was the world’s largest importer of major arms in 2012-16, accounting for 13 percent of the global total, and states from Asia and Oceania accounted for 10 of the world’s 20 largest importers[14].

However, despite these increases, military spending remains low compared to GDP in most of Asia and Oceania because Asian economies have also grown significantly during the past decade. Among the key military spenders in the region, only Singapore and South Korea spend more than two percent of GDP on defence[15]. During the cold war arms race in the 1980s, the Soviet Union’s military spending was estimated to vary between 8 percent and 25 percent. But the levels observed in Asia today sit far below this[16]. In addition, increases in military spending are uneven across Asia. National data reveals a diversity of spending choices among countries involved in East Asia. At one extreme, countries such as China and India increased defence expenditure by about 50 percent between 2011-15, while at the other extreme Japan, Malaysia, and Taiwan let their military spending stagnate or decline. But even these countries are planning on increasing their spending. There is a range of different motivations for these rises, some of which do not necessarily point to signs of inter-state tension and competitive behaviour. The modernisation of the People’s Liberation Army is a significant factor. But in addition, much of the increase in the Philippines’ defence spending, for example, is motivated by counter-narcotics operations.

Instead of a conventional arms race-style build-up, examples abound of acquisition decisions that target specific aspects of the military balance, even for states that have contained their increase in military expenditure. What is occurring in East Asian security is a mix of states that are trapped in spiralling security dilemmas. Also observable is the militarisation of specific conflicts of interests. No country is attempting to match the level of Chinese military expenditure as such, but states are instead seeking to boost their acquisitions significantly. Meanwhile, the militarisation of disputes creates new risks, as they are not matched by an ambitious preventive diplomacy or the adoption of confidence-building measures to reduce strategic distrust and the possibility of unintended incidents.

EU member states and arms sales to Asia and Oceania: Promotion and restraint

EU member states and EU-based companies are seeking to expand supplies to a number of states identified in the previous section, most significantly to Australia, India, Japan, and Singapore. Efforts are also being made to boost defence industry cooperation with Indonesia, Malaysia, the Philippines, and Vietnam. For the time being, the implementation of the EU arms embargo on China and other economic and political concerns will keep arms transfers to China to a minimum.

To a significant extent, European efforts are driven by domestic economic and political concerns. Since the 2008 economic crisis there have been calls in several EU member states for governments to play a more active role in promoting arms exports and streamlining export licensing processes in order to help offset national defence industry losses incurred by cuts in procurement budgets[17].

France, the UK, Germany, and Sweden have all – to a greater or lesser extent– identified expanding arms exports as essential if they are to maintain their existing defence capabilities. Maintaining sales abroad is therefore an element in European states’ own strategic considerations.

All of these states have also developed enhanced mechanisms through which they can help industry to promote arms sales abroad. They see Asia and Oceania as key region where growth can be achieved[18]. Both France and the UK have recently started to develop a security relationship with Japan that encompasses military-industrial cooperation[19]. In recent years, France and the UK have engaged in a range of bilateral exchanges with Vietnam on defence-related areas, including on defence procurement processes and arms acquisitions[20].

For France and the UK these attempts to boost arms sales in Asia and Oceania are also connected to broader geostrategic priorities. However, the exact nature of these priorities differs and tends to reflect national priorities rather than those established or coordinated at the EU level. For example, the UK sees Asia and Oceania as a region where it supports US strategic goals. It has therefore focused on building relationships with Australia and India. The French defence ministry has articulated a position in support of stability and freedom of navigation in Asia and presents France as a Pacific power, which helps develop French military-to- military ties with Australia, India, Japan, Malaysia, and Vietnam[21]. Military-to-military and strategic dialogues are an essential diplomatic tool for promoting arms exports, as the recipient needs to perceive the supplier as a security partner. Meanwhile, interviews with German officials for this paper reveal that Germany prioritises key partners in the region – Singapore and Australia – with which it is easier to link arms exports to strategic cooperation because they are clearly perceived as part of a Western camp[22].

These national approaches are only partly coordinated at the EU level – coordination is limited when it comes to controlling exports and extremely limited when it comes to supporting exports. Since the early 1990s the EU has developed a range of policy tools aimed at increasing the degree of coordination and convergence in member states’ arms and dual-use export controls. One key driver of the process has been the strong interest among the European defence industry, certain EU member states, and sections of the EU, in achieving greater coordination and streamlining of export control policies in order to facilitate cross-border cooperation. The EU began to use arms export controls as an instrument of its emerging foreign and security policy in the 1980s, through the imposition of arms embargoes. These embargoes lacked legal force until the creation of the EU’s Common Foreign and Security Policy (CFSP) in 1993[23]. Since 1989, the EU has imposed embargoes on China (1989-present) Afghanistan (1996-2001), Indonesia (1999-2000), Myanmar (1991-present), and North Korea (2006-present)[24]. While the Afghanistan restrictions restated United Nations-level arms embargoes, the China, Indonesia, and Myanmar arms embargoes do not have a UN equivalent. The North Korea arms embargo is broader in scope than measures adopted at the UN.

In the 1990s the EU began to develop coordinated policies for regulating the trade in dual-use items and – later – military goods[25]. The first EC Regulation governing the trade in dual-use goods entered into force in March 1995. Controls on member states’ trade in dual-use goods are currently governed by EC Regulation 428/2009 (the ‘Dual-use Regulation’)[26]. In 1998, EU member states adopted the EU Code of Conduct on Arms Exports, which was transformed into the legally binding EU Common Position on Arms Exports in 2008, which forms part of the EU’s CFSP[27]. However, despite the existence of EU arms embargoes, the EU Dual-use Regulation, and the EU Common Position, member states still have substantial leeway in terms of how their export controls are implemented at the national level. All of this continues to create significant variation with regard to decision-making about where EU member states arms exports efforts are focused and whether particular export licence applications are approved or denied. For example, in 2013, Germany approved the sale of 164 Leopard 2 tanks and infantry fighting vehicles to Indonesia[28]. The approval came despite the fact that a licence for a similar deal had previously been denied by the Netherlands[29]. Moreover, a study in 2015 showed that despite almost three decades of implementation there are still clear differences in the way that EU member states interpret and apply the 1989 EU arms embargo on China[30].

Meanwhile, the economic imperative remains strong. Sections of the European Commission are looking at ways in which it can help the EU defence industry respond to falling defence spending by boosting arms exports. A paper published by the commission in July 2013 on promoting a more competitive and efficient defence and security sector, notes that falling defence budgets have made exports to states outside the EU “increasingly important for European industries”[31]. The paper proposes that the commission develop a dialogue focusing on “how to support the European defence industry on third markets” and that it explore ways in which EU institutions can “promote European suppliers in situations where only one company from Europe is competing with suppliers from other parts of the world.”[32] The EU is also seeking to achieve greater economies of scale and increase competitiveness by promoting greater consolidation in the EU’s Defence Technological and Industrial Base (DTIB). In particular, the EU is promoting the common development and procurement of weapons systems, as part of broader efforts in the field of “pooling and sharing”, and through the attempts to reduce barriers to intra-EU cooperation in the European defence industry via, for example, the Intra-Community Transfers Directive (ICT Directive)[33].

However, EU efforts overall continue to generate limited returns, with states favouring national solutions over shared projects[34]. In addition, consolidation of the EU’s larger arms manufacturers has yet to materialise, as seen most dramatically in the failed merger between EADS and BAE Systems in 2012[35]. Indeed, in the field of ship- building – one of the areas where EU-based companies are producing systems that are in high demand in Asia and Oceania – the process of consolidation is, if anything, going into reverse. In 2005 the German company ThyssenKrupp Marine Systems (TKMS) purchased the Swedish submarine manufacturer Kockums. However, in 2014 the Swedish government stepped in and encouraged Saab to purchase Kockums, effectively bringing the company back under Swedish control[36]. Sweden was reportedly concerned about the long-term health of Kockums under German ownership and the acquisition was seen as helping to ensure that Sweden retained a sufficient level of naval production at the domestic level[37].

The Brexit referendum and the ongoing threats to the long- term health of the EU may lead to a deepening of cooperation among the remaining member states. If so, the EU could go on to develop more harmonised and coordinated export control policies. Discussions are already ongoing on revitalising efforts at boosting the European DTIB, promoting joint procurement efforts, and using EU funding to support military R&D. These have been areas where the UK has often been accused of blocking progress. These are also areas that have – traditionally – been one of the key drivers for EU action in the field of export controls. However, there are legal and political barriers that will challenge efforts aimed at ‘more Europe’ in the field of defence. The countries behind these efforts are doing so for very different reasons, with some seeing it as a way to create a genuinely European defence force while others are more focused on bringing investment to their own national industries.

In recent years, European countries and firms have faced a context defined by: spending cuts at home and an appetite for spending rises in Asia and Oceania; faltering defence industry consolidation; and export control restrictions which are, however, unevenly applied. These factors have led countries and firms to seek sales abroad, including in East Asia but without – yet – wielding the force that a consolidated European defence industry might enjoy. At EU level there is no geostrategic direction governing this policy area, and member states’ own strategic preferences are strongly governed by the need to secure sales.

Given these trends, what role are European countries and the EU itself playing? What influence are they currently exerting – and what could they be doing differently?

Key armaments trends in Asia: The role of EU member states

Despite faltering progress in defence industry consolidation, uneven application of export control rules, and an absence of overall strategic approach, EU member states’ influence on the evolving military balance in Asia and Oceania is significant in specific areas. As outlined above, asymmetric warfare has been central to the modernisation of the PLA since the 1995-96 Taiwan Strait crisis, when China failed to deter the US from sending two aircraft-carrier battle groups to the Taiwan Strait as a response to Chinese missile tests conducted to intimidate Taiwan during its first presidential election. The systems developed by China to considerably raise the costs of a US intervention into East Asia are called anti-access/area denial (A2/AD) by the US Department of Defence. Disruptive technologies and missile systems acquired by China include an anti-ship ballistic missile programme, cyber warfare, anti-satellite weapons to deny the US use of space-based assets during conflicts, and a range of missiles to deny sea control and air supremacy to the US forces[38]. Today, Japan, Vietnam, and Taiwan are also pursuing disruptive systems to raise the potential costs of Chinese naval operations in the East Asian maritime domain. For example, they are all acquiring different versions of anti-ship missiles, developed domestically in the case of Taiwan and Japan and with a Russian technology transfer in the case of Vietnam[39].

Three areas of the military balance display a pattern of highly competitive acquisition strategies in the form of ‘action- reaction cycles’: submarine and anti-submarine warfare, ballistic missiles and anti-missile defence systems, and the contest for air superiority.

To take submarine and anti-submarine warfare first, the proliferation of submarines in East Asia is driven by the considerable build-up of the underwater fleet of the PLA Navy, already the largest in Asia by the number of submarines it operates. The Chinese arms industry is currently conducting five different submarine programmes at the same time. Among the ten key spenders, nine navies – all except the Philippines’ – have recently acquired, or are in the process of acquiring, new submarines. The acquisition of submarines by Japan, Australia, Taiwan, and Vietnam are direct responses to the strengthening of the PLA Navy’s submarine fleet[40].

With a range of companies capable of producing advanced systems, EU-based suppliers have either won – or have been competing in – most of the major recent acquisition programmes. The EU’s presence in this market is greatly facilitated by the total absence of competitors from the US. The American defence industry produces neither diesel- powered submarines – focusing solely on nuclear-powered submarines which it does not export – nor ground-based anti-ship missiles. This leaves the field open to a range of suppliers from France, Sweden, and Italy – among others – that have significant capacities in these areas. This is also one of the few areas where, including supplying China, Chinese diesel submarines receive parts and components, their engines in particular, from Europe[41].

That said, as suggested above, Europe’s attempts to achieve greater dominance in international markets are constrained by the continued limitations in the consolidation of the EU defence industry, as shown by the recent ‘renationalisation’ of Kockums in Sweden. For the time being, there will continue to be multiple producers of submarines in Europe and no real attempt to achieve true economies of scale.

Europe’s impact in particular countries varies considerably. Japan, for example, has decided to increase its fleet of conventional submarines from 18 to 22 in 2018 to respond to increased Chinese activity in the East China Sea[42]. However, these are being built by domestic suppliers. Australia has launched a $38 billion programme to replace its existing fleet with 12 new conventional-powered submarines, largely in response to the modernisation of the PLA Navy and China’s assertive policies on maritime disputes. The submarines will be built in Australia under contract with French firm DCNS, with the first expected to enter service in 2033[43]. In winning the 2016 deal to supply Australia with submarines, France’s DCNS narrowly defeated a Japanese bid, something it reportedly was able to do largely because of the high-level political support provided the French government[44].

In early 2017 the Vietnamese Navy commissioned the sixth and last of the Kilo submarines it purchased from Russia under a 2009 agreement[45]. But since 2011 Vietnam has been in discussions with Damen of the Netherlands about the purchase of two Sigma Class Frigates. If the sale is agreed, the ships would be armed with French-made Exocet and Mica missiles and would significantly boost the volume of EU member states’ exports to Vietnam[46].

In Taiwan, the Tsai administration is launching an indigenous shipbuilding programme and plans to spend $14.8 billion up to 2040. In 2001 the Bush administration promised to supply Taiwan with conventionally powered submarines but the plans were abandoned due to Chinese pressure and lack of capacity in this area among US-based manufacturers[47]. If they are to be successful, Taiwan’s submarine plans will still likely be reliant on transfers of technology from the US[48]. EU suppliers could step in but member states have generally taken a conservative approach with regard to arms transfers to Taiwan for fear of damaging ties with China and because of their commitment to a ‘One China’ policy.

Malaysia, Indonesia, Singapore, South Korea and India are pursuing submarine acquisition programmes, largely in response to perceived potential threats that are separate and distinct from the rise of the Chinese Navy, although Malaysia and Indonesia have active maritime disputes with China in the South China Sea that are also influencing their planning. The Malaysian Navy has purchased two French- made Scorpène submarines (Perdana Menteri-class) under a contract signed in 2002. Indonesia has acquired three frigates from the UK – delivered in 2014 – and recently took delivery of the first of two Sigma Class Frigates from the Netherlands[49]. However, since the imposition of EU and US sanctions in late 1990s Indonesia has also been looking to move away from Western suppliers and expand its defence ties alternative suppliers, such as Russia and China[50]. In 2011, Indonesia signed a $1.1 billion contract for three diesel-electric submarines with Daewoo Shipbuilding and Marine Engineering of South Korea, beating out EU- based suppliers[51].

Singapore has contracted ThyssenKrup to build two customised submarines to add to its fleet of two, with a delivery expected in 2020[52]. The South Korean military has the most ambitious submarine programme of all navies in the region except for China’s and Japan’s, with its submarine force planned to reach 18 active boats in 2020. The construction of submarines for the South Korean Navy is indigenous but relies on cooperation with German firms[53]. South Korea’s submarine acquisitions are aimed at achieving maritime control in case of a military conflict with North Korea, but since North Korea is developing a submarine- launched ballistic missile the final aim is also to deny North Korea an undersea nuclear deterrent. Finally, the Indian Navy is in the process of acquiring six new Scorpène-class submarines, built locally under contract with DCNS[54]. While the modernisation of the Indian Navy aims primarily at ensuring Indian domination over the Indian Ocean, India has also expressed concerns regarding the situation in the South China Sea and is developing military cooperation with Japan and Australia.

Leading Asian spenders are also acquiring various anti- submarine warfare systems. While EU-based suppliers have significant capacity in these areas their supplies of these systems to the region have been limited, mainly because the process of acquisitions is driven by the US and Japan as they intensify their monitoring of Chinese submarine activity

A second element of acquisition policy that clearly shows a cycle of action and reaction is North Korea’s development of ballistic missiles and nuclear weapons, and the adoption of anti-missile defence in response to this – all of which has significant consequences for north-east Asian security. Here, EU member states have very little influence. Most of such systems supplied by states from outside the region are supplied by the US.

Equally, the third area of action-reaction – air superiority – is primarily a Sino-Japanese contest. The majority of supplies from outside the region come from the US and Russia. The Chinese arms industry is engaged in a highly ambitious attempt to produce the next generation of the PLA’s fighter aircraft. In response, the air power of the US- Japan alliance is being upgraded. Japan received the first four of a total of 42 F-35A in early 2016, and the US Marine Corps in Japan received the first F-35B (short take-off, vertical landing version for carrier operations) in early 2017.

Among the ‘action-reaction’ cycles at play as East Asian states seek new asymmetric capabilities, EU member states’ role in supplying key technologies is most significant in the area of submarine technology and certain other naval-based systems. It is important to understand the area in which EU member states are having an impact, and to understand the other key factors at play in the East Asian military balance.

Central to all this, of course, is the role of China. As suggested earlier, there is a variety of ways in which European countries and firms are – despite the embargo – aiding not just its strengthening as a military actor but also China’s transformation into a player in the defence industry.

Intangible and dual-use transfers: EU member states’ contribution to the Chinese arms industry

For almost a decade the EU arms embargo on China was a major bone of contention for EU-China relations. But today it is no longer an issue. After the 18th Party Congress in 2012, China effectively froze the problem – it simply stopped raising lifting the embargo as a specific request during EU- China summits and strategic dialogues, even at the most recent defence and security dialogue.

Together with the US, the EU imposed a politically binding arms embargo on China after the 1989 Tiananmen Square incident. The US has also sought to prevent EU-based companies from supplying military technology to China via the implementation of controls on the re-export of US technologies and diplomatic pressure on EU member states[55]. Nonetheless, the EU arms embargo is not legally binding and has been interpreted differently by individual member states, and US re-export controls do not apply when US-origin technology is not present. As a result, while complete weapons systems have not been supplied to China by EU member states since 1989, components and subsystems have been exported. For example, many Chinese submarines are powered by German-made engines or equipped with French sonar systems. China also produces military helicopters using French technology[56].

One of the key challenges of EU member states’ licensing authorities when it comes to assessing licences for the export arms and dual-use items to China is identifying ‘mixed recipients’ that cater to both civilian and military end-users and where there is a risk that the goods or technology will be used to benefit the capabilities of the PLA. Another issue is that many of the items that end up contributing to the development of China’s military capabilities are not covered by either arms or dual-use export controls. For example, the German-produced diesel engines used in Chinese- produced armoured personnel carriers, self-propelled guns, and submarines are not covered by the EU’s military and dual-use lists or the EU arms embargo. In addition, there is also little in the way of agreed standards at the EU level for regulating technology transfers and know-how which fall outside the scope of arms and dual-use export controls but which have a military end use.

Indeed, in recent years the EU’s contribution to the Chinese arms industry through intangible and dual use transfers has emerged as an issue in the China-Japan-EU-US quadrilateral relationship. Japan has repeatedly raised the legal transfers of EU arms and components to China within the framework of European export controls as a strategic issue, with Tokyo accusing EU member states of being too lax. But today this is no longer the case – Japanese concerns have been eased through dialogue. An uneasy balance has thus been reached whereby European exports of arms components and spare parts continue at an average annual value of €300 million, without generating any problem diplomatically with Japan or the US.

China changed its approach on the arms embargo because it concluded that this was not a realistic goal. But it also decided to prioritise access to high technologies within the existing framework of European export controls and restrictions – which ITTs enable it to do[57]. China is now focusing its diplomatic efforts on obtaining a lifting of the restrictions on exports of high-technology products. As the prime minister, Li Keqiang, repeated during the National People’s Congress this year, lifting those restrictions would lead to a significant reduction of the EU’s trade deficit with China[58]. Indeed, the economic relationship has become only more The EU’s trade deficit in goods with China was €180 billion in 2015, and China’s direct investment in Europe increased by 77 percent to €35 billion in 2016, including the acquisition of advanced technology assets[59]. While high-tech does not exclusively relate to the arms industry, it clearly includes technologies with a military end-use given the nature of Chinese current industrial policy priorities. China’s official spending on R&D rose 42 percent between 2012 and 2015[60]. The percentage of R&D supporting arms industry modernisation is not known precisely: R&D spending is not included in the official defence budget[61].

China becoming a net investor in the EU has prompted a reflection in Europe on the lack of reciprocity in EU-China investment relations – while the EU is largely open to foreign investment, China places restrictions on many sectors. There has been a strong political push in support of better screening of incoming Chinese investment, to ensure reciprocity and to protect the competitiveness of European economies. China is increasingly perceived as a future competitor in the manufacturing of high-technology products, and this also applies to the arms industry. In October 2016, Germany’s then economy minister, Sigmar Gabriel, accused China of being “on a shopping tour” in Europe “with a long list of interesting companies – with the clear intention of acquiring strategically important key technologies”. Gabriel called for an EU-wide “safeguard clause” which could be used to block foreign takeovers of firms whose technology is deemed strategic for Europe’s competitiveness[62]. In this context, the German government effectively blocked the takeover of the German chip manufacturer Aixtron by Fujian Grand Chip Investment Fund. It appeared that the main reason was that Aixtron supplies key components to NATO defence contractors, which resulted in a US intervention to block the deal, a German decision to halt the review process, and a Chinese decision to withdraw its bid[63]. In February 2017, the governments of France, Germany, and Italy sent a joint letter to EU trade commissioner Cecilia Malmström asking the EU to create a legal basis that would enable member states to investigate takeovers coming from state-owned entities and block them if necessary[64].

These new trends have emerged in the context of a new inflectionin China’s effort to promote civil-military industrial and R&D integration. Xi Jinping has brought what was a long-term goal for China to a new level of priority, creating a Central Commission for Integrated Military and Civilian Development, which he chairs himself[65]. As the Chinese arms industry moves up the technological ladder, support for high-technology innovation with military end-use is a matter of national priority. This has become a mantra for Xi, which he repeated at the last National People’s Congress in Beijing, presenting high-tech innovation as the “key to military upgrading”[66]. The list of priorities is long. A report in the Global Times identified “engine technology for military drones, satellite navigation and positioning, long- range radar detection and ballistic missile defence” as areas where “independent innovation” is needed[67].

This intensified effort to create a world-class arms industry is inseparable from Chinese ambitions on international export markets. According to SIPRI data, China is currently the world’s third largest arms supplier, ahead of France, Germany, and the UK. In recent years, China has been winning new contracts for weapons systems such as submarines and drones, showing a qualitative upgrade in its export policy. The 2016 Zhuhai Airshow Salon was the occasion to promote export of armed drones, with a major push to put in the media spotlight the Caihong-5 (CH-5), the equivalent of the US Reaper, produced by China Aerospace Science and Technology Corporation[68].

Adopted in 2013 by the State Council, the plan “Made in China 2025” captures the new intersection between industrial policy, support for innovation, the importance of high- technology and civil-military integration. Although the plan aims at a comprehensive upgrade of China’s manufacturing sector, it also identifies ten priority industries, six of which have a clear military application: new advanced information technology, machine tools and robotics, aerospace and aeronautics, maritime equipment and high-tech shipping, new energy vehicles, and new materials[69].

Although it would only be possible to fully quantify the trend if Europe engaged in a coordinated attempt to collect data in all member states, anecdotal evidence points to Chinese acquisition of European assets in priority sectors of China’s industrial policies with possible applications in the arms industry. There are cases of acquisition of firms with activities both in the civilian and in the military sectors. Aviation Industry Corporation of China International has been particularly active in acquiring assets in Europe that serve both its military and civilian capacities. For example, in 2015, the international branch of AVIC purchased AIM Altitude, a leading British company in the area of aeroplane cabin interiors. AIM Altitude is also active in the defence sector, producing cabin interiors for military aircraft, including thermal and acoustic insulation and the production of composite materials that have applications in radar panels, missile containers, and radomes[70]. In January 2016, AVIC and Han’s Laser Technology acquired Spain’s Aritex, a provider of aviation and automobile assembly automation. Han’s Laser commented that it expected “to gain access to Aritex’s patented technologies and expand into the aviation and military sectors through this acquisition”[71]. In 2013, AVIC International had already acquired Thielert Aircraft Engines, a producer of engines with several military applications, including in US-built drones[72].

However, direct acquisition is only one of several modus operandi used by the Chinese government and Chinese firms to access European technologies. Access to European technology with an impact on the Chinese arms industry also proceeds through the establishment of joint ventures that require licensing in China. For example, the new joint venture signed in early 2017 between China State Shipbuilding Corporation and Finnish company Wärtsilä specialises in high-tech ship applications, such as “project engineering and management, automation, navigation and communication systems, dynamic positioning systems, electric propulsion systems, power distribution systems, safety and security systems, and full systems integration”[73]. German company Dornier Seawings has established a joint venture headquartered in Wuxi with two Chinese partners to “design, produce, sell and support amphibious aircraft that offer operators enhanced mission capabilities”[74].

Anecdotal evidence abounds of European contributions to the modernisation of the Chinese arms industry through intangible technology transfers. This reflects an ambitious Chinese plan to modernise its arms industry to meet the country’s needs and win export markets globally.

Conclusion

The European Union is frequently criticised for lacking the ambition and ability to think about East Asian security in strategic terms. Should it begin to do so, this policy brief has shown that Europe’s impact on Asian military security is larger than usually acknowledged, and is not limited to EU statements in support of international law. This review of Europe’s impact on the Asian military balance shows that European countries and firms support several Asian states in their efforts to avoid a destabilising unbalance vis-à-vis China’s military power. However, this amounts to ‘policy by default’ rather than the fulfilment of a thought-through strategy. At neither EU or member state level is there a clearly formulated strategic vision to govern Europe’s impact on the military balance in East Asia, nor is there any conscious intention to become an external balancer in East Asia through transfers and export denials of military technology. Instead, economic considerations are prime – particularly the need to bolster states’ domestic defence industries by supporting arms exports abroad. Where member state governments and the European Commission do act, they do so largely to support sales efforts. They also respond to the strict restrictions limiting to a very low level transfers of military technology to In the case of France, the United Kingdom, and Germany, some degree of geostrategic thinking has taken place, but these nevertheless reflect policies and priorities drawn up at the national level, rather than EU-wide policy priorities. This only adds to the European ‘policy by default’ impact on East Asia.

With regard to China, Europeans need to understand the importance of its move away from seeking an end to the arms embargo. European countries need soon to work out how to respond to the rise of China as a leading producer and exporter of weapons. European firms contribute to the modernisation of the Chinese arms industry through intangible technology transfers, even if this contribution is – currently – limited. On one side of the table is China, which has made a decisive strategic shift and is steadily prosecuting this through diplomacy, highly centralised strategic planning, and robust state support to its industrial policies. Europe sits on the other side of the table with no strategic approach to China at all in this domain. To what extent has it even registered China’s change in priorities? It is not currently clear that Europe has assessed its own potential impact on the development of Chinese defence, nor how it wishes to respond. There is a certain lack of coherence between these two aspects of Europe’s impact on the Asian military balance. Exports of complete weapons systems demonstrate that Europe is taking advantage of the necessity felt by many Asian states to avoid excessive unbalance with growing Chinese military power and to seek cooperation with allies and partners of the United States. But Europe is not following a strategy aiming at counterbalancing China; it is merely responding to a set of opportunities and constraints.

This is fast becoming a strategic issue in EU-China relations for several reasons. First, Europe is contributing to China becoming a competitor on global markets without thinking in terms of economic security or long-term competitiveness. Second, 2017 is a key year in EU-China relations when it comes to investment relations. It is anticipated that the negotiation of a bilateral investment treaty will resume – the EU and China seek to take advantage of the uncertainties around the Trump’s administration foreign trade policy and deepen the institutionalisation of their economic ties. The rise of Chinese investment in the EU and the uneven playing field for European companies in China have put the issue on the top of the EU foreign policy agenda, with ‘reciprocity’ and ‘investment screening’ the key words of a new approach. Third, the question of ITT is raised by the EU’s partners, which view the modernisation of the Chinese arms industry as a security risk. Under Shinzo Abe, the Japanese government has been particularly active at raising the issue, especially with France, the UK, and Germany. With the security situation in East Asia only likely to intensify, European partners are unlikely to drop these concerns.

The EU has only recently started a reflection on arms exports, but the focus is on exports as part of an industrial policy. It is not in the DNA of the EU to address arms sales as a foreign policy tool because it thinks of itself as a normative power. In addition, in the absence of a consolidated European arms industry, the EU will not be in a position to guide exports so that they shape the Asian security environment in a way that supports European strategic goals. The EU is very unlikely to adopt a clear-cut policy of supporting the Asian states which balance the rise of China’s military power. This would require identifying China as a major threat to international peace, which is by far not the prevailing perception in Europe. Even Japan under Abe is not moving to a strategy of outright balancing against China. A clear-cut strategic decision of choosing sides is therefore not needed, and the current ambiguity serves European interests.

However, the EU needs to instil greater coherence into its approach to military transfers and their impact on East Asian security. Exports and export restrictions should be recognised as an important element of Europe’s influence. While it is not necessary to adopt specific guidelines, the EU can use existing policy coordination institutions (like COASI, the Asia and Pacific directorate at the European External Action Service) to bridge differences between member states on the question of the Asian military balance. The EU has only broad guidelines to govern arms export, and requires detailed reporting from member states on their deals with foreign customers. At the minimum, therefore, member states should refine the existing mechanisms to ensure that no member state will take advantage of an export denial in another member state to push for their own exports. At the maximum, member states should formulate clear policy goals attached to their arms exports and export control practices towards specific regions, to avoid only commercial interests guiding licensing decisions.

There is also an urgent need to address two issues. First, the EU needs a policy on intangible technology transfers. The tools for sharing information about strategic acquisitions are too weak, and a shared definition of strategic acquisitions is needed. This needs to be prioritised in the ongoing European reflection on the adoption of an EU-level investment screening system. Such a policy might constitute an investment screening system to regulate foreign investment at the EU level (especially mergers and acquisitions) in companies that have military end-use technologies or know- how. Also beneficial would be a policy at the EU level to regulate research cooperation with military end-use. Ideally this could be an EU common position.

Second, the EU needs to anticipate the risk of post-Brexit Britain leveraging its arms industry for commercial gains in ways that undermine Asian security. It needs to make sure that Britain will remain aligned to European practices on arms transfers and intangible transfers, especially if the EU’s approach becomes more sophisticated in future. Britain will have an incentive to attract more foreign investment. This area should be addressed in the EU-UK Brexit talks.

Caution and restraint is needed in the area of arms exports The EU is the only structure that can be at the centre of European efforts to strategically coordinate the policies governing arms export, export control, and the approach to incoming foreign direct investment in sensitive sectors, with a view to also protecting European economic security. As a responsible international actor, it must step forward to safeguard both its own interests and security and also that of East Asia.

References

Par : Mathieu DUCHÂTEL, Mark BROMLEY

Source : European Council on Foreign Relations

Mots-clefs : Armement, Asie, Asie de l'est, Chine, Europe, Influence, Militaire, Union Européenne